Becoming a homeowner is an exciting milestone, but it also comes with its fair share of financial responsibilities. After the initial costs of buying your property—deposit, legal fees, mortgage setup—it’s important to stay on top of your finances and avoid unnecessary expenses. Whether you’re in your first home or upgrading from a flat, these money-saving tips will help you protect your investment and manage your new budget like a pro.

1. Create a Realistic Post-Move Budget

Once you’ve settled in, it’s time to reassess your budget. Homeownership brings a range of new expenses—council rates, home insurance, maintenance, and possibly higher utility bills. Take a few hours to:

- List all your new monthly costs

- Track your actual spending over the first three months

- Allocate a portion of your income to home maintenance and unexpected repairs

If you’ve taken out a loan to help cover the cost of renovations or furnishings, factor in your repayments too. If you’re struggling with multiple debts, consider debt consolidation to reduce your overall repayment costs.

2. Review Your Utility Providers

Many homeowners stick with the same energy, internet, and insurance providers from their previous rental—often without checking if those are the best deals. Comparison websites like Powerswitch make it easy to shop around and change providers. Even small monthly savings across power, broadband, and insurance can add up to hundreds per year.

Tip: Consider bundling services or switching to a provider offering first-year discounts, but always check what the cost jumps to after the initial term. You don’t always get a better deal when you bundle your services, so compare offers carefully.

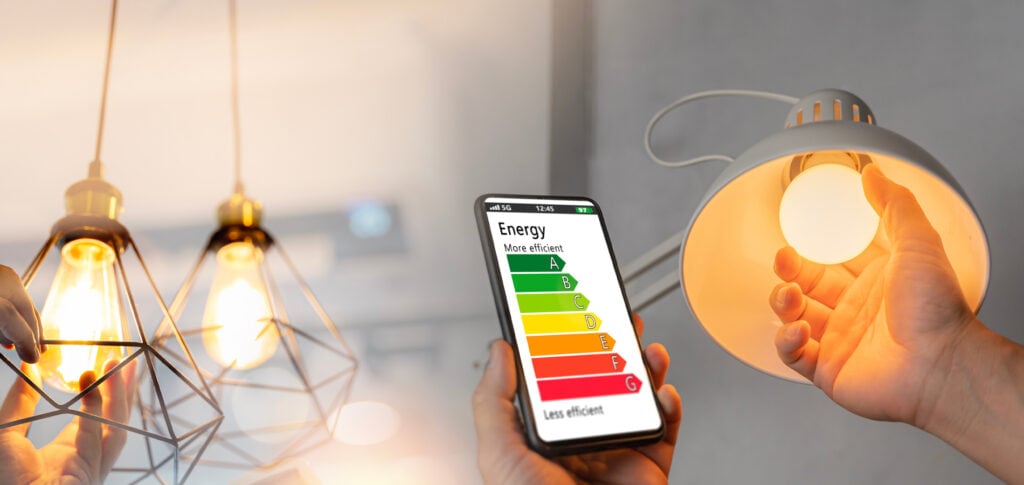

3. Make Your Home Energy Efficient

Improving your home’s energy efficiency not only reduces your carbon footprint—it also saves money.

Here are a few low-cost ways to get started:

- Switch to LED lightbulbs

- Use draught stoppers and door seals to prevent heat loss

- Insulate your hot water cylinder

- Run washing machines and dishwashers on eco settings

Longer term, consider investing in insulation or double glazing. These might come with an upfront cost but will save you significantly on power bills over time. You may even be eligible for government grants or low-cost loans to help.

4. Do It Yourself—When It Makes Sense

Basic home maintenance can be done without bringing in tradespeople every time. Learning how to:

- Paint a room

- Clear gutters

- Replace a tap washer

- Fill small holes in the wall

…can save you hundreds over the course of a year. YouTube is an excellent resource for learning the ropes. That said, know your limits—don’t attempt complex plumbing, gas, or electrical work without a qualified professional.

5. Plan Ahead for Maintenance Costs

It’s tempting to spend any leftover cash on décor, but home repairs will pop up whether you’re ready or not. A good rule of thumb is to set aside 1% of your home’s value annually for maintenance.

For example, if your home is valued at $600,000, budget around $6,000 per year—or $500 per month. This can go towards roof repairs, repainting, appliance replacement, or other upkeep.

Keeping your home in good condition also protects its long-term value, helping you avoid large costs down the line.

6. Get Smart With Your Loans

If you’ve borrowed money for renovations, furniture, or to top up your deposit, make sure your loan is still working in your favour. At Loan Direct, we specialise in helping new homeowners get better rates on personal loans. Whether it’s unsecured or secured lending, we can access a network of low-cost lenders on your behalf.

We move fast—our application takes just 2 minutes, and approval can happen within 1–2 hours*. Best of all, same-day payout* is possible, so if you’re facing a time-sensitive cost, we’ve got you covered.

Our secured loan rates start from 9.95% and unsecured from 11.95%. And if you’re dealing with a less-than-perfect credit history, we may still be able to help. We believe in second chances and finding fair solutions.

7. Furnish Gradually, Not All At Once

It’s easy to get swept up in Pinterest boards and showroom displays, but furnishing your home doesn’t need to happen overnight. Prioritise essential items first—beds, a sofa, fridge—and build the rest over time.

Look out for second-hand bargains online or in local community groups. Many people sell high-quality furniture when they move or redecorate. You’ll also avoid buying items you may not actually need.

8. Take Advantage of Council and Community Programmes

Many local councils offer subsidised home improvement schemes, compost bins, insulation grants, or even low-interest loans for sustainability projects. These can be a great way to reduce your long-term costs while improving your home.

Join community Facebook groups or neighbourhood apps—these are goldmines for free plants, leftover paint, advice from seasoned homeowners, and local service recommendations.

9. Keep an Emergency Fund

Owning a home means you can’t just call a landlord if something breaks. From burst pipes to a faulty oven, emergencies can strike at any time.

Try to build an emergency fund equivalent to 3–6 months of essential expenses. This acts as a buffer for unexpected repairs or job loss—and means you won’t have to rely on high-interest credit cards if disaster strikes.

10. Consider Loan Consolidation If You’re Feeling the Pinch

If you’ve ended up with several high-interest debts after your home purchase—credit cards, BNPL accounts, or personal loans—it might be worth consolidating them into one, lower-rate loan. At Loan Direct, we make it easy to roll multiple debts into one manageable payment, potentially reducing your interest and simplifying your finances.

We don’t believe in red tape or hoop-jumping. Our process is 100% online and designed to be as hassle-free as possible.

*Subject to responsible lending checks and criteria.