If you’re searching for things like “quick loans no bank statements”, or “instant cash loans online no paperwork”, then it’s likely you need cash, fast, online, and without the hassles of paperwork.

Sounds like a tall order, but not for Loan Direct.

Here’s how we make it happen.

- With Loan Direct, everything is done online: simply provide us with a few key details and we can get the ball rolling.

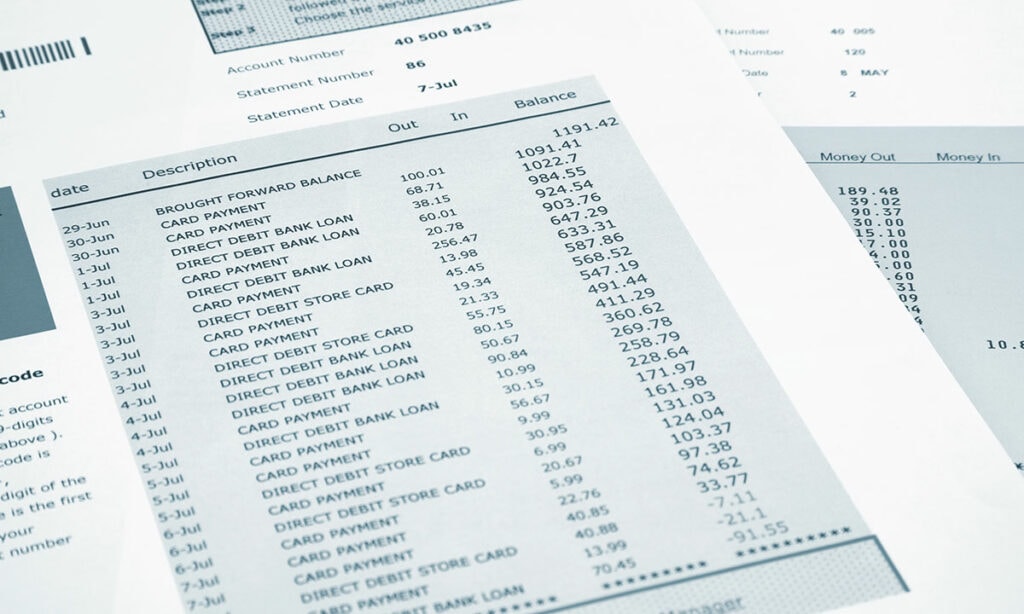

- We send you a link to provide access to your bank statements, and we assess your application from there.

- Then, we’ll put your loan application in front of a range of lenders to get you the best deal. It couldn’t be easier – or quicker!

- Our simple, direct lending process means there’s no need for you to take precious time to come visit us face-to-face.

Let us give you the best of both worlds – fast loans and competitive interest rates, direct to you!

So, what are the benefits of getting a loan online?

Is an online loan better than going to a bank?

While banks are often the first places people think of when they need a loan, there are some advantages to choosing an online loan through a loan broker, like Loan Direct.

An online loan simply means everything is done online and there’s no need to visit a branch or fill in any paperwork to get your loan sorted.

Loan Direct is an online loan broker, which means when you apply for a loan through us, we approach several different lenders with your application so you can get a better deal.

These are some of the reasons an online loan can be better than going to a bank:

Online Loans can work out cheaper

A website review of personal loan rates from New Zealand’s largest banks found standard rates starting at 12.90%, compared with 9.95% with Loan Direct.

Personalised interest rates

Why is this important? The rates offered by banks for personal loans can be found online. Although some offer lower rates for students and homeowners, it’s a pretty one-size-fits-all approach. If you have good credit and discretionary income, you may get a better deal by going direct to Loan Direct!

You could borrow more online

Most banks offer up to $30,000 in unsecured loans personal loans, but online lenders like Loan Direct can offer as much as $50,000. You can make a big difference when you have an extra $20,000 when you’re renovating, buying a car, or consolidating debt.

Can I get an Instant Loan online with no paperwork?

People looking for instant loans can find fast solutions with Loan Direct.

It’s not possible to get an “instant loan” as such, but if you’re looking for one, you probably need cash quickly.

You can certainly get same-day loans, but any responsible lender will need to verify your ability to repay the loan before lending you money.

Applying for a loan with Loan Direct is easy. Simply provide us with some basic information and we’ll handle the rest.

You will need to provide us with a photo ID and allow us access to your online bank statements (using the secure link we provide).

When you apply online, you won’t need to take time out of your busy schedule.

Even better, our process has no paperwork! You can do it without documents from anywhere. So easy!

Can I get a quick loan with no bank statements?

If you’re searching for ‘quick loans no bank statements’, either you don’t want to submit paperwork or… you have something to hide.

A responsible, low-cost lender, such as Loan Direct, will need to determine your ability to repay your debt. It is best to avoid the alternative if you don’t want sharks circling. It’s not a good idea to borrow money from lenders who won’t do these checks. Doing so will end up costing you a lot more in the long run! Avoid the financial and mental stress at all costs.

But here’s the thing – we may be able to help you even if you’re struggling to manage your money right now.

Here’s how we do it.

One way we help people reduce their loan repayments and increase their discretionary income is through debt consolidation loans. There are many people who can borrow extra cash at the same time, subject to responsible lending checks naturally. Lowering your repayments is possible by paying off your existing debts and taking out a lower-cost loan spread over a longer period of time. Let’s get your bank account looking healthy again!

Fast approval, same-day loan

Once we’ve got all the information we need from you, we can usually get approval within 1-2 hours.

After that, we’ll arrange to have the funds deposited into your bank account the same day.

Depending on your bank, and the time of day we get the approval, the funds may appear that day or the following day.

The earlier in the day you apply, the better the chances of getting your funds that same day.

FAQ's

We offer online loans 100% online – no long forms or need to email bank statements.

It is necessary for us to have access to your bank accounts. The purpose of this is to determine your ability to repay the loan. It is important that your repayments are affordable.

A link will be sent to you giving us permission to view your statements online. The process is quick, easy, and secure. Bank statements do not need to be emailed to us.

We make loan payments as affordable as possible at Loan Direct. We’ll look at all aspects of your borrowing situation. If you are struggling to repay your existing loans, we can help you consolidate them with a debt consolidation loan.

We offer flexible repayment options and lower interest rates to make payments more affordable.

We offer loans with a minimum term of six months. For most borrowers, short-term loans aren’t the best option. Do you live paycheck to paycheck? By reducing your monthly loan repayments and giving you a top-up, we can make living more comfortable for you.

An instant loan is basically a personal loan, and you can use it for anything – unanticipated expenses, medical expenses, everyday expenses, travel expenses, vet payments – pretty much anything you need cash for fast. But that doesn’t mean they get approved instantly! It’s still subject to responsible lending checks.

Most of our loans are unsecured, but if you have bad credit, you may need to put a car as collateral.

It depends on what you can afford. Our loans start around $2,000 and go up to $50,000 unsecured and $150,000 secured, though we sometimes lend more.

For an estimate of what your repayments will be, use our personal loan calculator.

Our interest rates start at 9.95%. However, if you have bad credit you’ll pay more than this. The most you’ll be charged is 35.50%.